colorado springs vehicle sales tax rate

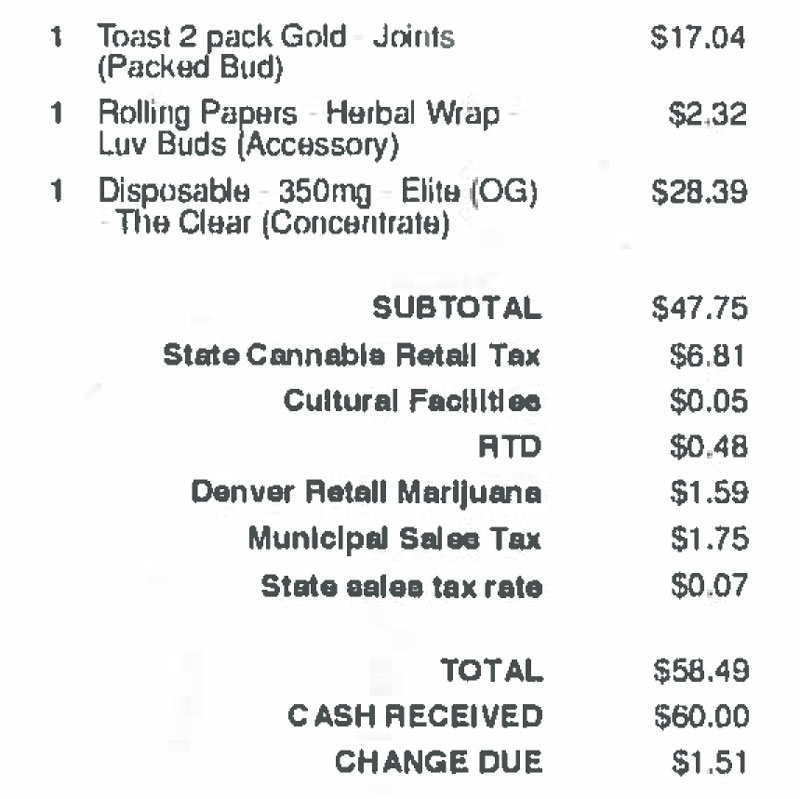

The December 2020 total local sales tax rate was 8250. Motor vehicle dealerships should review the DR 0100 Changes for.

Colorado Springs New Vehicles Chevrolet Honda Volkswagen

5 rows 27 lower than the maximum sales tax in CO.

. The GIS not only shows state sales tax information. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

Sales Tax Rates in the City of Glenwood Springs. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123.

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. This is the total of state county and city sales tax. All PPRTA Pikes Peak Rural Transportation Authority.

Its important to note this does not include any local or county sales tax which can go up to 83 for a total sales tax rate of. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

The Colorado Springs Colorado general sales tax rate is 29. AUTOMOTIVE VEHICLES TAX GUIDE PAGE 3 Residency Continued Common Examples 1. The current total local sales tax rate in Colorado Springs CO is 8200.

The 82 sales tax rate in Colorado. The average cumulative sales tax rate in Colorado Springs Colorado is 781 with a range that spans from 513 to 863. Vehicles do not need to be operated in order to be assessed this tax.

Colorado has a 29 sales tax and El Paso County collects an additional 123 so the minimum sales tax rate in El Paso County is 413 not including any city or special district. This includes the rates on the state county city and. What is the sales tax rate in Pagosa Springs Colorado.

In Colorado localities are allowed to collect local sales taxes of up. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is. Sales Tax Return Changes The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods.

The current sales tax in Colorado is 29. Sales Tax Breakdown Colorado. Groceries and prescription drugs are exempt from the Colorado sales tax Counties.

State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood. Depending on the zipcode the sales tax rate of Colorado Springs may vary from 29 to 825. Ownership tax is in lieu of personal property tax.

The Colorado sales tax rate is currently. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. The ownership tax rate is assessed on the original taxable value and.

A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. A state tax rate of 29 applies to all car sales in Colorado but your total tax rate will include county and local taxes as wellwhich may add up to 8. This is the total of state county and city sales tax rates.

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Used Car Dealership In Colorado Springs Co 80915 Buy Here Pay Here Byrider

Winter Park With Highest Sales Tax Rate In The State And Fraser See Increases In Sales Tax Revenue Skyhinews Com

Taxes Fees El Paso County Clerk And Recorder

Car Tax By State Usa Manual Car Sales Tax Calculator

Grow The Economy Colorado Springs District 1 Candidates Say Colorado Public Radio

Vehicle Inventory Colorado Springs Co 80915 Byrider

Sales Tax Information Colorado Springs

How Colorado Taxes Work Auto Dealers Dealr Tax

Pre Owned 2008 Chevrolet Silverado Lt2 2wd Pk U9966 58 In Colorado Springs Carhop

3650 Jeannine Dr Colorado Springs Co 80917 Loopnet

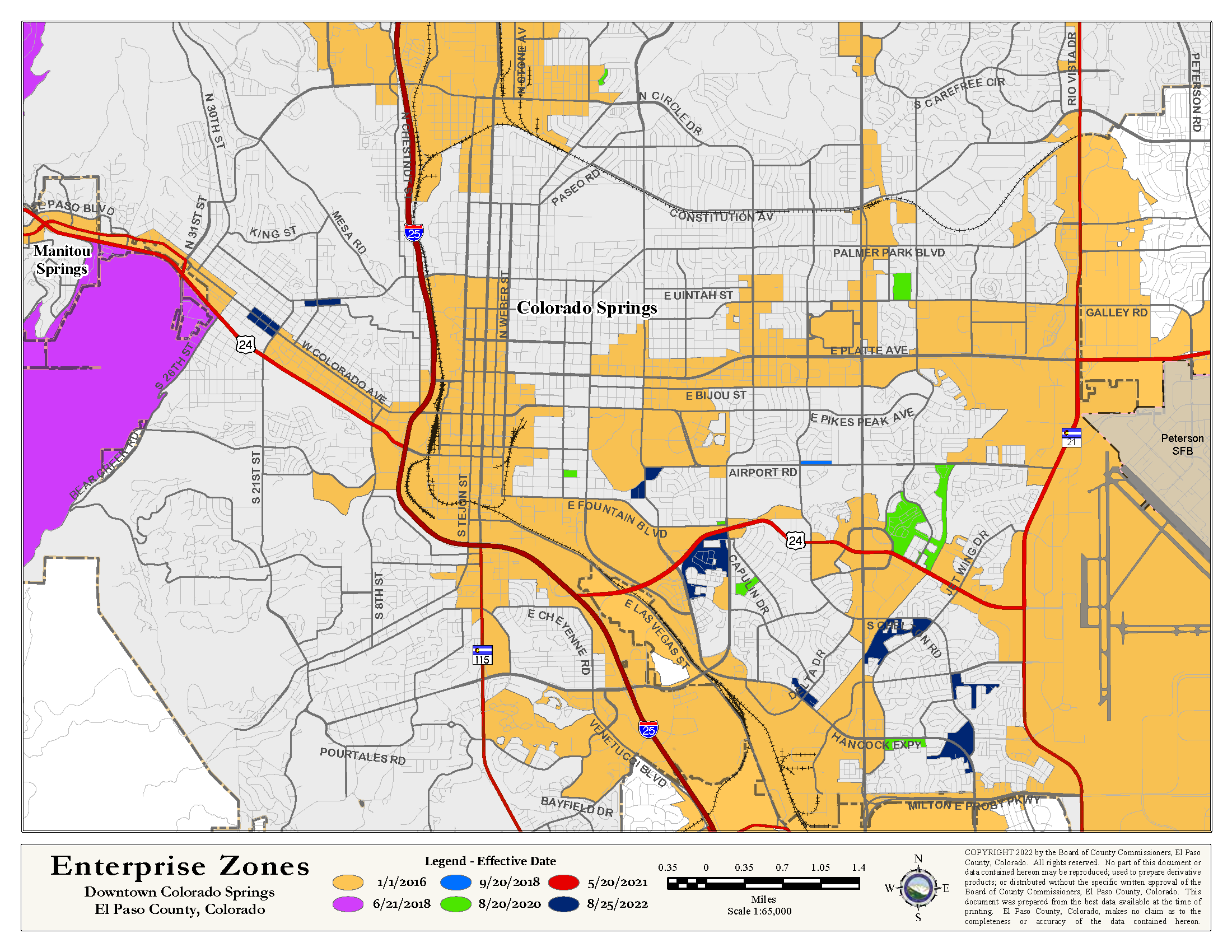

Pikes Peak Enterprise Zone El Paso County Administration

Colorado Springs Cost Of Living Colorado Springs Co Living Expenses Guide

Used Car Dealership Colorado Springs Co Used Cars Lakeside Auto Brokers